Canada’s Rising Inflation

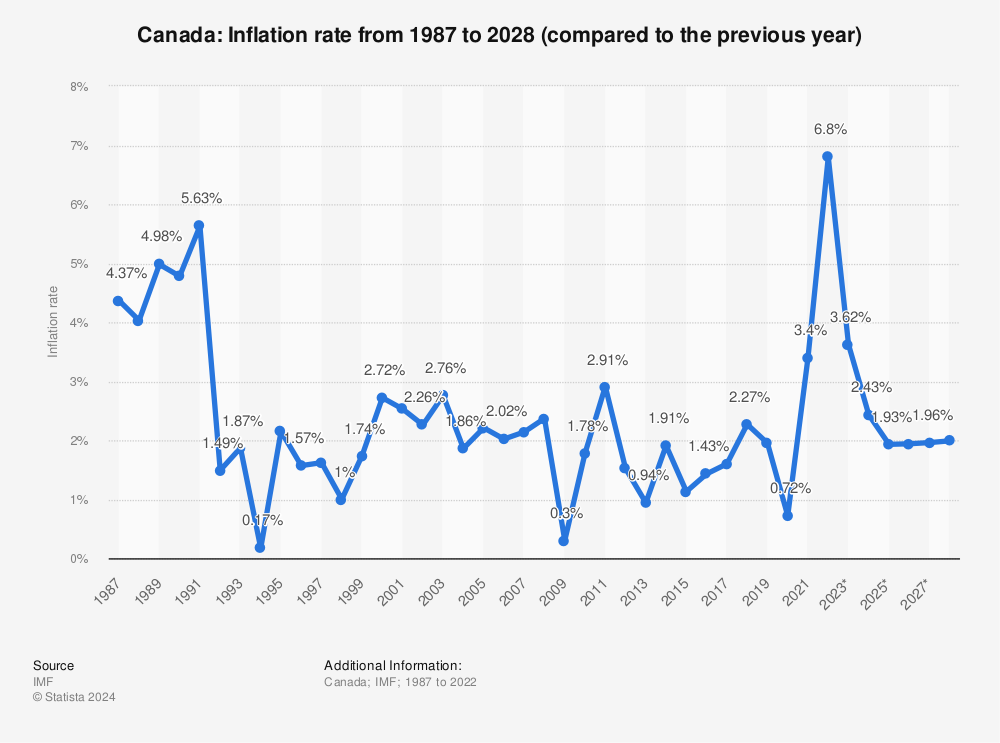

In 2021, Canada’s Consumer Price Index (“CPI”) rate grew at the fastest pace in 30 years, primarily driven by widespread supply chain issues.

The CPI increased by 3.4 per cent, according to Statistics Canada. A healthy inflation rate, as defined by the Bank of Canada is between 1 and 3 per cent, with 2 per cent being the midpoint target.

The CPI is an economic indicator measuring prices of a fixed selection of common consumer goods and services, such as fuel and groceries. The Bank of Canada considers the CPI the best tool to measure cost of living and inflation.

The component of consumer goods that increased the most was gasoline, which increased by 31.2 per cent. Transportation as a whole increased by 7.2 per cent.

Food prices overall increased by 2.5 per cent; meats cost 4.3 per cent more and fresh produce cost 2.6 per cent less compared to last year.

The only sector that decreased in price was clothing and footwear, which lowered by 0.3 per cent.

There are a few main factors causing the increase in inflation.

Supply chain issues have affected global trade, leading to an increase in demand but a decrease in supply. Goods become more scarce and consequently more expensive.

Additionally, consumers were buying fewer goods in 2020. Now that people are getting back to their pre-COVID routines, they have a pent-up demand for items they couldn’t or wouldn’t buy during the earlier stages of the pandemic.

Many of these factors have effects not limited to Canada. The United States’ CPI rose by 7.5 per cent in 2021, while both Germany and the United Kingdom’s CPI rose by 4.9 per cent—much higher than yearly averages.

Canada’s inflation rate will likely continue to increase throughout 2022. A report by Dalhousie University in Nova Scotia forecasts a 5 to 7 per cent rise in food prices throughout the year.

Deputy Governor of the Bank of Canada, Toni Gravelle, believes there is no clear end to these global problems.

“If supply disruptions and related cost pressures persist for longer than expected and strong goods demand continues, this would increase the likelihood of inflation remaining above our control range,” he noted to the Surrey Board of Trade back in December 2021.

Experts believe that if inflation continues at the rate it is, without an equivalent increase in wages, many Canadians will not be able to afford basic consumer goods in the coming years.